9 Easy Facts About Transaction Advisory Services Explained

The Transaction Advisory Services Statements

Table of ContentsEverything about Transaction Advisory ServicesNot known Incorrect Statements About Transaction Advisory Services Transaction Advisory Services for BeginnersFascination About Transaction Advisory ServicesTransaction Advisory Services Can Be Fun For Anyone

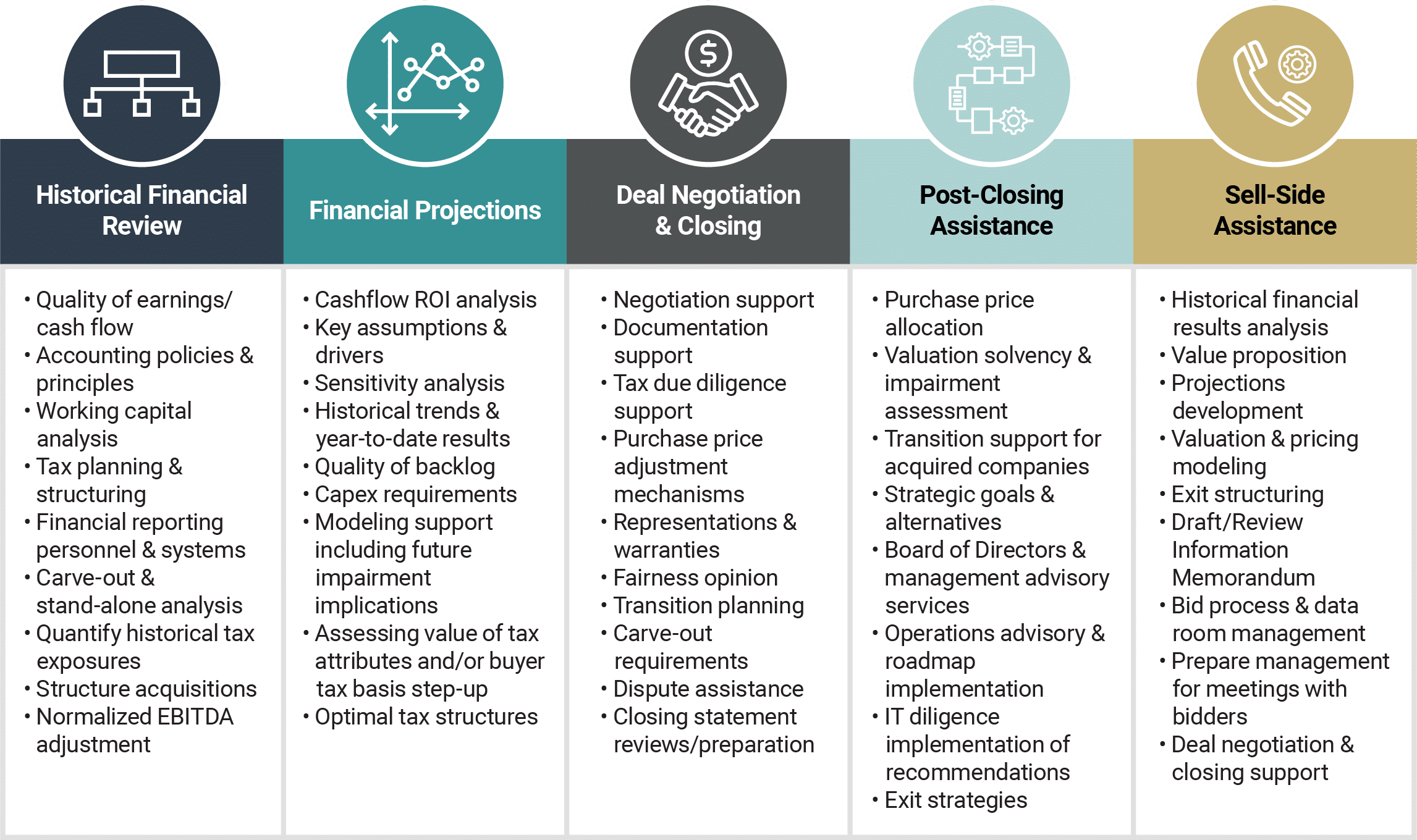

This step makes certain the organization looks its best to prospective purchasers. Obtaining the company's value right is critical for an effective sale. Advisors make use of various approaches, like affordable money circulation (DCF) analysis, contrasting with similar firms, and recent deals, to find out the reasonable market worth. This aids set a fair rate and work out successfully with future customers.Purchase experts action in to aid by getting all the required information arranged, answering inquiries from buyers, and setting up visits to business's location. This builds count on with purchasers and keeps the sale moving along. Getting the ideal terms is crucial. Transaction experts use their competence to assist business proprietors deal with challenging arrangements, satisfy buyer expectations, and framework offers that match the owner's objectives.

Satisfying lawful policies is essential in any type of service sale. They help organization owners in planning for their next steps, whether it's retirement, starting a new venture, or managing their newfound wealth.

Transaction advisors bring a riches of experience and knowledge, making sure that every element of the sale is taken care of professionally. Through strategic preparation, valuation, and negotiation, TAS helps local business owner accomplish the highest possible sale cost. By making certain lawful and governing conformity and managing due diligence together with other deal employee, transaction experts minimize possible risks and liabilities.

Not known Details About Transaction Advisory Services

By comparison, Huge 4 TS teams: Job on (e.g., when a potential buyer is performing due diligence, or when a bargain is shutting and the purchaser needs to incorporate the firm and re-value the seller's Equilibrium Sheet). Are with charges that are not linked to the deal shutting effectively. Earn costs per engagement someplace in the, which is less than what investment banks make also on "little offers" (but the collection chance is additionally much greater).

The interview inquiries are really comparable to investment financial interview concerns, but they'll concentrate much more on audit and assessment and much less on topics like LBO modeling. Expect inquiries about what the Adjustment in Working Capital ways, EBIT vs. EBITDA vs. Earnings, and "accounting professional just" topics like test balances and exactly how to stroll through occasions utilizing debits and credit scores as opposed to monetary declaration changes.

The Ultimate Guide To Transaction Advisory Services

Professionals in the TS/ FDD groups might also interview monitoring regarding whatever above, and they'll create a thorough record with their findings at the end of the procedure.

, and the basic shape looks like this: The entry-level function, where you do a lot of information and financial evaluation advice (2 years for a promotion from right here). The next degree up; similar job, but you get the even more fascinating little bits (3 years for a promotion).

Particularly, it's challenging to obtain advertised beyond the Supervisor level due to the fact that couple of people leave the task at that phase, and you need to begin showing evidence of your capability to generate profits to advance. Allow's start with the hours and way of life given that those are simpler to explain:. There are periodic late nights and weekend break job, but nothing like useful content the frenzied nature of financial investment banking.

There are cost-of-living adjustments, so expect lower compensation if you're in a less expensive place outside major monetary (Transaction Advisory Services). For all settings except Companion, the base pay consists of the mass of the complete settlement; the year-end bonus could be a max of 30% of your base pay. Typically, the very best method to enhance your profits is to switch to a different company and work out for a higher salary and bonus offer

Indicators on Transaction Advisory Services You Should Know

You might enter into business advancement, but investment banking obtains harder at this stage because you'll be over-qualified for Expert duties. Company financing is still a choice. At this phase, you need to just remain and make a run for a Partner-level function. If you wish to leave, possibly relocate to a client and execute their appraisals and due persistance in-house.

The major issue is that due to the fact that: You normally require to join one more Big 4 group, such as audit, and job there for a few years and after that relocate into TS, work there for a couple of years and then move right into IB. And there's still no warranty of winning this IB role due to the fact that it depends upon your area, clients, and the employing market at the time.

Longer-term, there is additionally some the original source risk of and since assessing a company's historical monetary details is not exactly rocket scientific research. Yes, human beings will certainly always need to be involved, however with advanced technology, lower headcounts might potentially sustain customer engagements. That stated, the Deal Providers team beats audit in regards to pay, job, and leave opportunities.

If you liked this short article, you may be curious about analysis.

Some Ideas on Transaction Advisory Services You Need To Know

Develop sophisticated economic structures that help in figuring out the actual market price of a firm. Give consultatory operate in connection to business evaluation to assist in negotiating and prices frameworks. Discuss the most suitable kind of the deal and the sort of consideration to utilize (cash money, stock, gain out, and others).

Establish activity prepare for danger and direct exposure that have been determined. Perform combination preparation to identify the procedure, system, and business adjustments that may be needed after the bargain. Make numerical quotes of assimilation costs and benefits to examine the economic rationale of assimilation. Set guidelines for incorporating divisions, technologies, and service processes.

Analyze the potential consumer base, sector verticals, and sales cycle. The operational due persistance provides vital insights into the performance of the firm to be obtained concerning risk analysis and worth development.